Looking for a loan officer job description to get a thorough insight on their duties?

Before sending out your resumes for a loan officer job, you must have a proper understanding of what this role entails.

Besides, customizing your loan officer resume according to the job description can help boost your chances of getting shortlisted for interviews.

So, what does a loan officer do?

When customers walk into a bank or any other financial institution seeking loans and mortgages to help finance their real estate purchase, business start ups or vehicles, loan officers are their first point of contact.

You see, the chief duty of a loan officer is to act as a liaison between financial institutions and borrowers.

Loan officers who deal particularly deal with home loans, are known as Mortgage Loan Officers or MLO and are responsible for determining whether or not a customer is qualified to acquire a loan based on their credit score, financial status, and financial history.

Once loan officers complete the application process of qualified customers and prepare all the necessary documentation, they submit the completed paperwork to the loan processor, who is responsible for ensuring the accuracy and completeness of the paperwork.

Read on to get clarity on the following questions related to a loan officer job description for resume:

- What are the job duties of a loan officer?

- What are some loan officer resume skills that candidates can showcase?

- What are the requirements to become a loan officer?

- What is a loan officer job description sample?

- What are the most common mortgage loan officer interview questions?

- How much do loan officers make in a year?

Loan Officer Responsibilities

Where do loan officers work and what are their duties?

A loan officer can be employed by a variety of commercial banks, mortgage companies, credit unions, and other financial organizations.

The following list of loan officer duties will give you a broader context of their day to day responsibilities at work:

- Assisting customers with their loan application by advising them on the most suitable loan option

- Acting as a salesperson to persuade potential customers to opt for a mortgage from their company as opposed to other banks or financial institutions

- Determining customer’s credit eligibility to proceed with the loan documentation etc.

- Interviewing loan applicants to discuss their financial situation and creditworthiness

- Calculating the interest rates and setting up repayment plans for the mortgage

- Efficiently communicate with the customers to provide them with all the necessary details and update them with the progress of their loan application

- Justifying the approval or denial of the applicant’s loan application based on the underwriter’s decision

- Staying up to date with the local and state financial regulations to ensure compliance with them at all times

- Updating on job knowledge on the various types of loans and new industry trends

- Maintaining accurate account records of approved customer loans along with their personal details

- Completing loan contracts after communicating the policy details and restrictions to the approved applicants

- Developing referral networks by suggesting alternate channels to cross-sell related products and services as part of meeting monthly quotas

- Providing excellent customer service and building rapport with clients to nurture trust, loyalty, and long term business relationship

- Preparing and submitting complete paperwork to the loan processor to advance the loan progress

- Using various loan origination software to streamline the process and efficiently manage loan pipeline

- Resolving customer queries and guiding them throughout the application process

Also read: What are some resume points for mortgage loan processor resume?

Loan Officer Skills for Resume

Apart from having good communication skills and analytical skills, an ideal loan officer needs to possess interpersonal skills that can facilitate their day-to-day dealings with customers.

Take a look at these key skills listed below that you can consider adding to your loan officer resume to impress the recruiters:

| Loan Portfolio | Customer Service |

| Finance & Banking | Relationship Building |

| Sales & Revenue Generation | Credit Management |

| Record keeping & Documentation | Client Management |

| Regulation Compliance | Multifaceted |

| Time Management | Financial Advising |

| Financial Accounting | Business Communication |

Also, technical skills like familiarity with various loan origination software are a must-have skill that you can include in your resume depending on your knowledge.

Given below are some of the commonly used loan origination software used by loan officers:

- Loansifter

- Floify

- Finflux

- LendingPad

- OnlineApplication

- TurnKey Lender

- Encompass Digital Mortgage Solution

- Encompass360

Besides directly listing these skills in your resume, you can showcase them in the professional experience section of your loan officer resume as well, like so:

- Developed strong knowledge of the loan origination, underwriting, and closing procedures to implement the same at work

- Built rapport with customers to nurture trusting relationships with customers and other loan originators as part of customer retention

- Provided timely and complete documentation of loan application to facilitate operations and swift application progress

- Utilized 5+ proprietary loan origination software to analyze and process loan applications for the mortgage industry

- Ensured hassle-free loan application process to 100+ customers by clearly communicating details about lending programs, guidelines, and regulatory requirements

Also read: What skills should you you put in a resume?

Loan Officer Job Requirements

Aside from possessing the stated skills, you need to meet other loan officer qualifications to get hired.

The minimum educational requirement is a bachelor’s degree in finance, economics, or accounting.

In addition to that, most recruiters opt for candidates who have at least 3 years of work experience in the same field.

Employers also require candidates to have a Mortgage Loan Originator (MLO) license from the Nationwide Mortgage Licensing System (NMLS) which includes passing a written test with 20 hours of coursework, background, and credit checks.

You can prepare for NMLS tests by taking any one of the following courses that will help you pass the examination:

- OnCourse Learning MLO Courses

- MLO Training Academy (Affinity)

- VanEd NMLS Review

- Online Ed Review Courses

- CompuCram NMLS Review

- Kaplan Mortgage Licensing Education

- Learn Mortgage

Also read: How to write an impressive personal banker resume?

Mortgage Loan Officer Job Description Sample

Take a look at the following mortgage loan officer job description sample that you'll come across in job listings:

Job Overview

Crystal Bank is looking to grow our team of mortgage loan officers at one of our branches in Boston, Massachusetts. We are a local, private-owned bank that embraces the values and principles of the communities we serve. The ideal mortgage officer who will join our team will have 4+ years of relevant experience working at a financial institution with good credit management knowledge, a proven track record of business development, and good communication and teamwork skills.

Status: Full-time

Responsibilities:

- Identifying, engaging, and initiating mortgage loan processes for potential clients

- Preparing, analyzing, and verifying loan applications for real estate purchases

- Evaluating the clients' credit history through interviews, financial background checks, and financial documents to determine creditworthiness

- Maintaining knowledge of the latest trends and developments in the real estate market, lending rates, updates on rules & regulations, and best practices in the industry

- Reccomending cost-effective loan programs according to the clients’ needs

- Developing and maintaining contacts with local builders, realtors, and developers to promote bank services for mortgage

- Following audit, risk, and compliance controls to mitigate risk whilst providing quality customer service

Requirements:

- A bachelor's degree in finance, business, or accounting (preferably)

- Minimum of 4 years of relevant experience in banking or related field

- Must possess verified NMLS ID

- Familiarity with using financial software programs like Encompass loan origination software

- In-depth knowledge of Federal National Mortgage (Fannie Mae), conventional loans, Federal Housing Authority (FHA), Veterans Affairs (VA), and different types of construction loans

- Extensive understanding of mortgage loan procedures and policies

- Exceptional interpersonal and customer service skills, and attention to detail"

Mortgage Loan Officer Interview Questions

While you prepare your resume to start applying for loan officer jobs, it’s beneficial to begin your interview preparations as well to solidify your chances of bagging the position.

Have a look at the following interview questions for loan officers:

- How would you bring in clients when the market is not great?

- In your personal opinion, what are the three most important skills of a good loan officer?

- What are your strengths and weaknesses as a loan officer?

- On average, how many loans did you submit per month at your most recent loan officer job?

- What do you consider your biggest accomplishment as a loan officer to date?

- Tell me about the most challenging loan file you've dealt with. What did you learn from this experience?

- What are your best closing techniques?

Besides these profile specific questions, recruiters are also likely to ask you general interview questions such as:

- Tell me about yourself.

- What are your strengths and weaknesses?

- What do you know about our company?

- Why should we hire you?

- Why do you want to work for us?

- Where do you see yourself in 5 years?

- Why did you leave your previous job?

Try to practice answering these questions and have a mental outline as to how you’re going to answer these questions during the interview.

Even if the recruiters happen to ask you questions that you haven’t prepared for, you must answer them with confidence and maintain positive body language.

Also read: What are the top job interview questions in 2022?

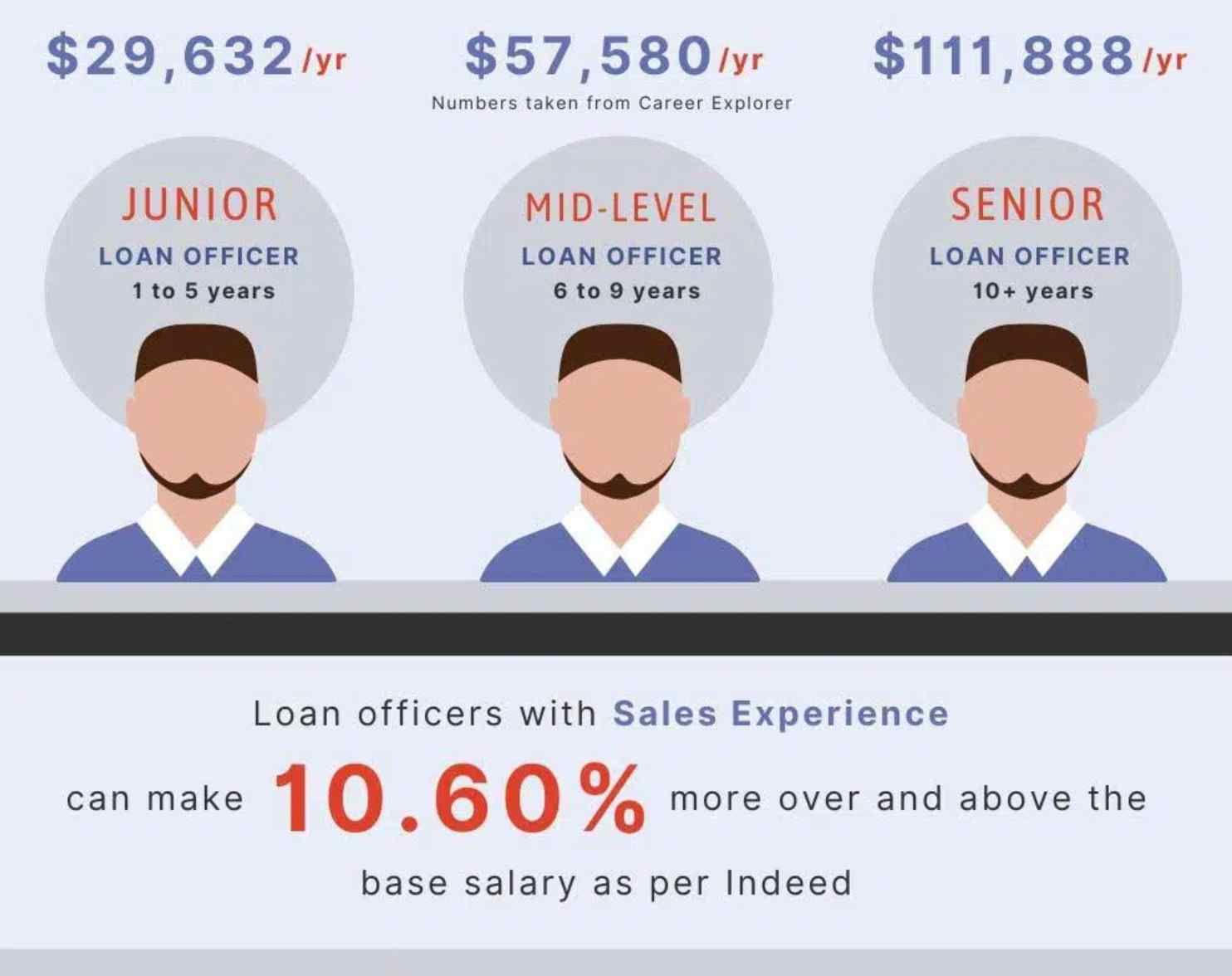

Loan Officer Job Salary

The salary of a loan officer in the US is influenced by factors like experience level, employer, location, and skills.

While the average salary of a loan officer in the US is $49,591 per annum, a professional with less than 1 year of experience can expect to earn about $38,051 in a year.

Meanwhile, experienced professionals with 10+ years of experience can earn $56,238 per year.

Given below are some of the highest paying US states for loan officer jobs:

| STATES | AVERAGE SALARY |

|---|---|

| New York | $104,400 |

| Maryland | $92,060 |

| Hawaii | $91,880 |

| Georgia | $86,200 |

| Missouri | $82,880 |

Also read: How to negotiate your salary in 2022?

Key Points

- Loan officers act as a liaison between financial institutions and the borrowers.

- Loan officers are generally known as Mortgage Loan Officers or MLO.

- MLOs are responsible for assessing the applicant’s credit score, financial status, and financial history to process loan applications.

- Besides listing the key skills directly in your resume, you can showcase your loan officer skills in the professional experience section.

- Aspiring loan officers must possess a Mortgage Loan Originator (MLO) license issued by the Nationwide Mortgage Licensing System (NMLS).

- It’s always beneficial to prepare in advance for loan officer interviews to boost your chances of getting hired by impressing the recruiters.

- The average salary of a loan officer in the US is $49,591 per annum.

For any further assistance, you can visit our career platform with 24x7 chat support or write to us at support@hiration.com.