Business and finance roles are expected to see nearly 1 million job openings annually through 2033, fueled by industry growth and retirements.

While opportunities are plentiful, so is the competition.

Every year, thousands of graduates enter the finance job market with similar degrees and aspirations. And to truly stand out, you need more than just academic credentials.

So how can you set yourself apart and show employers you’re ready to excel in this fast-paced industry?

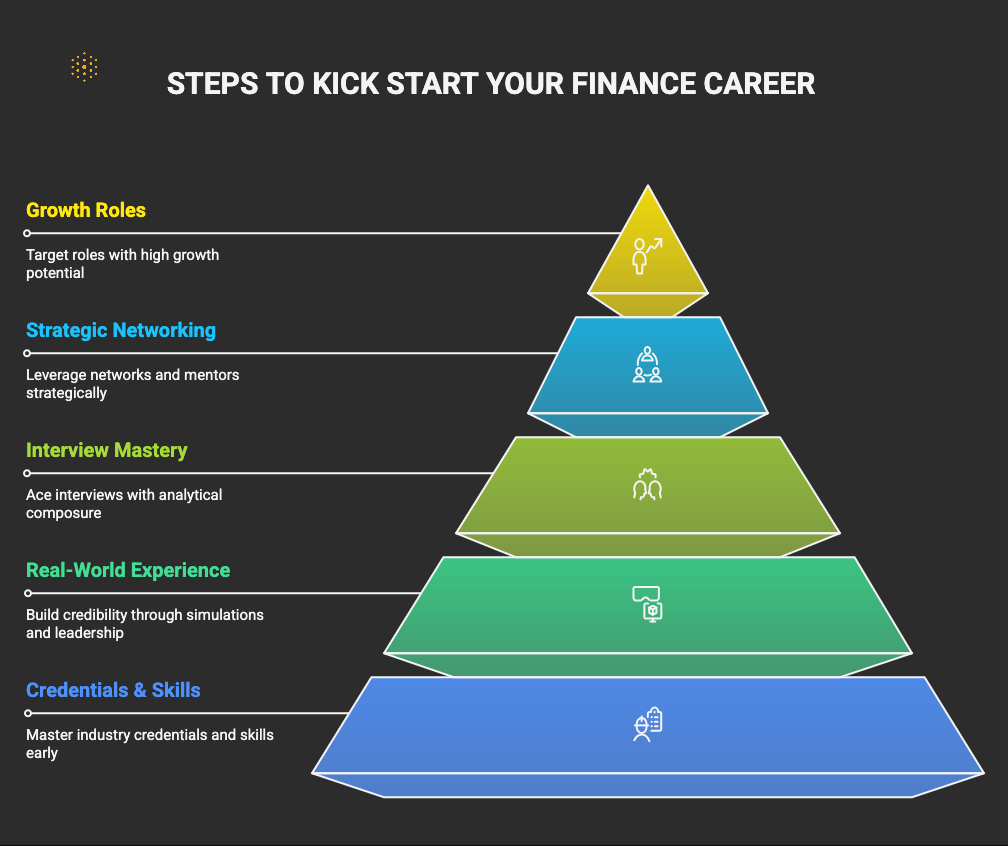

Read on to discover how - by earning key certifications early, building real-world expertise, expanding your network strategically, and targeting roles that set you up for long-term success.

1. Go Beyond the Degree: Master Industry Credentials Early

Your degree is a great foundation, but in finance, showing you're willing to go the extra mile with industry-specific credentials can be a game-changer.

It tells employers you're serious and already thinking like a pro.

- Take the SIE Before Recruiting Season: This is a no-brainer! The FINRA Securities Industry Essentials (SIE) Exam is an introductory exam that you can take without needing sponsorship from a firm. Passing it before you even start applying signals incredible proactive interest in the industry. You can learn more about the SIE exam directly from FINRA.

- Start CFA Level 1 Prep: Even if you're not fully enrolled in the program yet, beginning your studies for the CFA (Chartered Financial Analyst) Level 1 exam speaks volumes about your dedication. Many financial analyst job postings list CFA candidacy as a huge plus. It shows you're not just looking for a job, but a career, and that you're committed to rigorous self-improvement in finance.

- Bolster with Micro-Courses: Want to show you've got tangible skills? Consider intensive bootcamps or micro-courses, especially those focused on financial modeling. Programs like those offered by Wall Street Prep can teach you complex modeling techniques in just a few days.

Also Read: What do different finance jobs pay?

2. Build Real-World Credibility Through Simulations & Thought Leadership

It's one thing to talk the talk; it's another to show you can walk the walk. In an entry-level role, proving you have a grasp of real-world scenarios and can think critically is incredibly valuable.

- Use Market Simulators to Create a Track Record: Ever tried a stock market simulator? These platforms are fantastic for building a "portfolio" and demonstrating your diligence and analytical commitment without risking actual money. It's a low-stakes way to prove you can research, make decisions, and track performance. Many brokerage firms offer free virtual trading accounts, like Investopedia's own Stock Simulator.

- Start a Niche Finance Newsletter or Blog: Don't just follow the news - contribute to the conversation! Starting a blog or a niche newsletter where you share insights on current financial issues (like inflation trends, interest rate changes, or specific sector analyses) is a powerful way to showcase your domain expertise. The key here is to offer insights, not just generic tips. Platforms like Substack or Medium are great for this.

- Teach Others: Tutor Peers on Valuation Models or Macro Trends: Teaching is one of the best ways to solidify your own understanding. If you can explain complex topics like valuation models or macro trends to your peers, it not only reinforces your knowledge but also signals strong communication and leadership abilities to potential employers. This "advising-as-teaching" approach, as Investopedia puts it, is highly effective.

Also Read: What are the highest paying jobs in finance?

3. Ace Interviews with Analytical Composure & Fresh Perspectives

Interviews are your moment to shine. It's not just about rattling off facts; it's about demonstrating your thought process, your analytical capabilities, and your unique perspective.

- Know the Markets Inside-Out: This is non-negotiable. Be ready to discuss recent Federal Reserve decisions, bond market movements, or major economic indicators, and explain how they might impact corporate finance. Interviewers want to see that you're engaged with the financial world beyond your textbooks. Market knowledge is key to kick start your finance career. Follow reputable financial news sources like The Wall Street Journal or Bloomberg.

- Walk Through Your Mental Process: For brain-teasers or case questions, don't just blurt out an answer. Articulate your assumptions, outline your thought process, and structure your response clearly. Interviewers often value your method and logic more than a quick (and potentially incorrect) answer.

- Bring a Differentiated Idea: This is where you truly stand out. For financial analyst roles, consider preparing a concise, 2-minute "mini-thesis" on a stock or sector that genuinely interests you. Ground it in recent data and be ready to defend your reasoning. This demonstrates proactive thinking, genuine passion, and your ability to synthesize information - a huge plus for any employer.

4. Leverage Networks and Mentors - Strategically

You've heard it before: "It's all about who you know." While that's partially true, it's more about how you know them and how you leverage those connections. Networking should be strategic, not just a series of random coffee chats.

- Informational Interviews > Vague Coffee Chats: When you reach out for an informational interview, come prepared with specific, data-driven questions. Instead of "What's it like working here?", ask "What metrics define success for your team in the current market?" This shows you've done your homework and are genuinely interested in their specific role and the company's challenges.

- Tap Alumni in Target Firms: Your university's alumni network is an incredibly valuable resource. Reach out to alumni working at your target firms. They can offer invaluable insights, help you rehearse your pitch, refine your resume, or even prep you for technical tests. This kind of targeted guidance is far more effective than simply submitting applications blindly. Most university career centers can help you connect with alumni.

- Join Domain-Focused Communities: Don't underestimate the power of niche groups. Whether it's a local chapter focused on "Python in Finance" or an online community for "ESG Investing," these groups provide fantastic opportunities to meet contacts, gain insider intel, and stay current on industry trends. They can also lead to mentorship opportunities you wouldn't find otherwise. LinkedIn groups are a great place to start looking.

Also Read: How to make a resume for investment banking roles?

5. Target Roles with High Growth & Skill-Building Potential

Not all entry-level roles are created equal. Some offer far more opportunities for rapid learning and career advancement. Here are four roles that provide strong entry-level impact and great skill-building potential:

- Investment Banking Analyst: This role is often seen as a fast-track into the world of high-stakes deal-making. While the hours are long, the exposure to complex transactions, corporate finance, and M&A is unparalleled.

- Financial Analyst: This role offers broad exposure to various financial functions within a company, making it a gateway to many different career paths. You'll often be involved in budgeting, forecasting, and performance analysis.

- Junior Tax / Accounting Associate: These roles are crucial for compliance and offer deep visibility into a company's financial operations. You'll gain a strong understanding of financial statements and regulations.

- Personal Financial Advisor: This field is projected for significant growth (17% by 2032, according to the U.S. Bureau of Labor Statistics). It's client-facing and focuses on building strong relationships while providing crucial financial guidance.

Wrapping Up

Breaking into the finance industry takes more than ambition, it requires preparation, strategy, and the right tools to showcase your potential.

By earning certifications early, building real-world experience, and cultivating a strong professional presence, you can set yourself apart in a competitive job market.

If you’re ready to take the next step, Hiration can help.

From crafting ATS-friendly resumes and optimizing your LinkedIn profile to practicing interviews with AI-powered feedback, our platform is designed to help you stand out and land the role you’ve been working toward.

Start building your edge today and take the first step toward a successful career in finance.