Chief Business Officer Pay—What matters most in salary, bonus, and equity?

A CBO’s compensation is a mix of base salary, annual bonus (STI), and long-term incentives (LTI) such as RSUs or stock options—often the largest value driver. Package size varies by company stage, industry, and location. For negotiations, benchmark against true peers, clarify bonus metrics you can influence, prioritize equity size and vesting/refresh cadence, and secure protections (severance, change-in-control). Total value—not just base—determines real upside.

Understanding what a Chief Business Officer earns in the U.S. isn’t always straightforward.

From base salary and annual bonuses to long-term equity incentives that drive most of a CBO’s wealth, every component plays a strategic role.

Whether you’re evaluating a current offer, preparing for a negotiation, or benchmarking compensation for your organization, knowing how these packages are built - and what truly moves the numbers, can help you make informed decisions.

Here's a break down of average CBO salaries, pay differences by experience, the full compensation mix, and the factors that influence total rewards across the U.S.

What is the average Chief Business Officer (CBO) salary in the US?

The average gross salary for a Chief Business Officer (CBO) in the United States is approximately $236,016 per year, with an additional average annual bonus of $44,843, according to ERI SalaryExpert's 2025 data.

CBO Salary Benchmarks by Experience

Executive compensation for this role varies significantly based on tenure and expertise:

- Entry-Level CBOs (1-3 years of experience) typically earn an average salary of $161,590.

- Senior-Level CBOs (8+ years of experience) can command an average base salary of up to $295,328, according to ERI SalaryExpert.

Also Read: What are the 7 things you must consider before accepting a job offer?

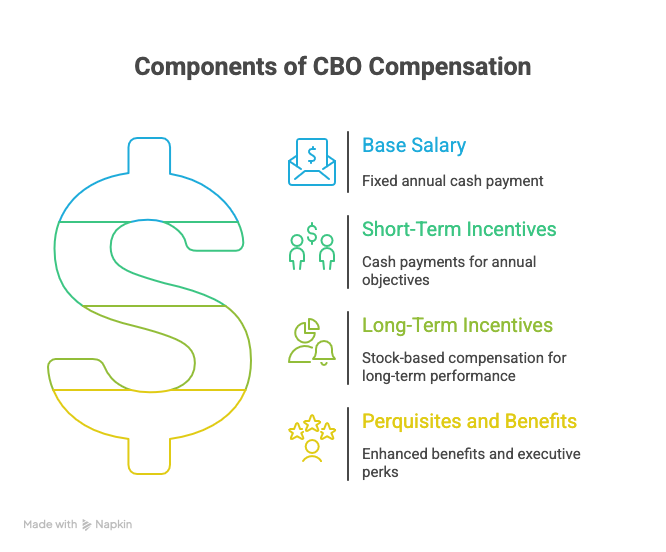

What are the key components of a CBO's compensation package?

The CBO compensation package is typically a strategic combination of Base Salary, Short-Term Incentives (STI) or Annual Bonus, and the most significant component, Long-Term Incentives (LTI) or Equity Compensation.

Like other Named Executive Officers (NEOs), a CBO's total pay is structured to align their financial interests directly with the long-term performance of the company, a practice common in US corporations.

- Base Salary: This is the fixed annual cash payment. While this can reach $1 million at large public companies, it is generally the smallest portion of the total package.

- Short-Term Incentives (STI)/Annual Bonus: These are cash payments tied to achieving annual performance objectives, such as hitting revenue targets, achieving profitability, or meeting key operational milestones.

- Long-Term Incentives (LTI)/Equity Compensation: This constitutes the largest and most variable part of the package. It is structured as stock-based compensation (e.g., Stock Options or Restricted Stock Units (RSUs)) to reward performance over a three-to-five-year period, creating the greatest shareholder value, as explained by Diligent.

- Perquisites and Benefits: This includes enhanced benefits, deferred compensation, and executive perks.

Also Read: How to negotiate a relocation package that works for you?

What factors influence a Chief Business Officer's total compensation?

A CBO's total pay is primarily influenced by three key factors: the Company's Size and Stage (e.g., startup vs. mid-market), the Industry Sector, and the Geographic Location of the role.

Company Size & Stage

The pay mix shifts dramatically based on the company's maturity and revenue:

- Mid-Market Companies: These established, high-growth private firms typically offer CBO packages ranging from $275,000 to $350,000 annually, plus a competitive blend of bonuses and equity, according to the Executive Recruit Chief Business Officer Salary Guide.

- Venture-Backed Startups: Early-stage companies use high equity stakes to offset lower cash compensation. For a Series B startup, the base salary for a CBO generally ranges from $180,000 to $240,000. C-suite executives at startups often receive significant equity, typically ranging from 0.8% to 5% of the company, according to HubSpot's guide to startup equity compensation.

Industry Sector

Industries with complex, competitive environments tend to pay a premium.

High-paying sectors for CBOs include financial services, healthcare, and consulting, as these roles often involve high stakes and specialized strategic knowledge.

Geographic Location

Compensation is also heavily adjusted for the cost of living and the competitiveness of the talent market.

Executive pay in large metro locations, such as Silicon Valley, New York, or Boston can offer a premium of up to 21% compared to roles in smaller metro areas, as detailed in a BDO USA report on private company executive compensation.

Also Read: How to answer salary related questions in an interview?

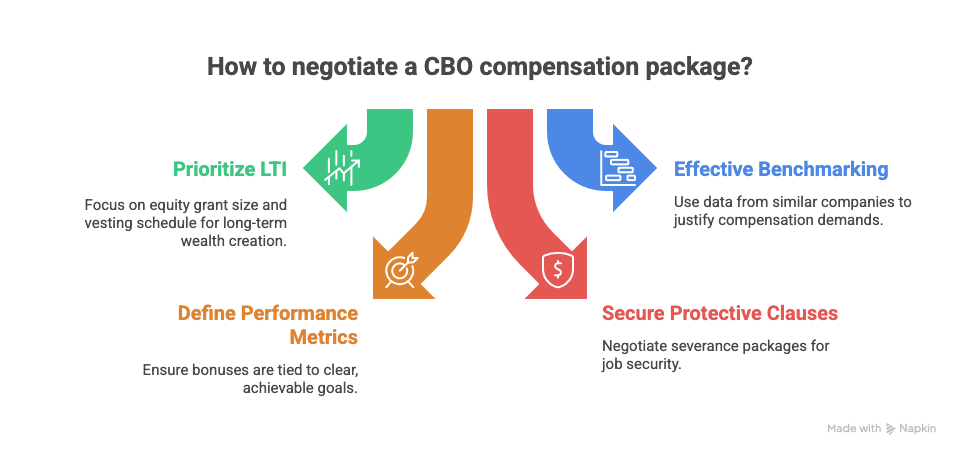

How should a CBO candidate negotiate their compensation package?

CBO candidates should focus their negotiation on the total value of the package, prioritizing Long-Term Incentives (LTI), benchmarking effectively, defining clear performance metrics for bonuses, and securing protective clauses like a severance package.

- Prioritize the LTI Component: Since equity is the primary driver of wealth creation in an executive role, candidates should negotiate for a favorable equity grant size and vesting schedule, which directly impacts the value of the compensation over time.

- Effective Benchmarking: Negotiation should be grounded in data, using benchmarks from similar companies that match the organizational size, industry, and geographic location of the prospective employer.

- Define Performance Metrics: The annual bonus (STI) structure should be clear and tied to strategic and operational goals that the CBO can directly impact, such as M&A integration success or new business line growth.

- Secure Protective Clauses: It is standard practice to negotiate a severance package or "golden parachute." This protects the executive by guaranteeing compensation if their role is terminated following a change-in-control, such as a merger or acquisition, according to Diligent.

Wrapping Up

Navigating CBO compensation takes more than understanding salary ranges - it requires context, market data, and a clear view of how each component of the package creates long-term value.

Whether you're stepping into your first executive role or renegotiating at the senior level, informed decisions can change the trajectory of your career.

For leaders looking to refine their career documents or present their experience with clarity and impact, Hiration offers AI-powered support that can help you showcase the full scope of your executive accomplishments.

From resume optimization to interview preparation and LinkedIn optimization, our platform supports professionals at every stage of their career journey, so you can focus on elevating your impact at the top.

Chief Business Officer Compensation — FAQs

What’s a typical CBO pay mix?

Base salary (usually the smallest share), an annual bonus tied to operating goals, and a long-term equity grant (RSUs or options) that vests over multiple years. Benefits, deferred comp, and executive perks can be included.

Which component usually drives the most wealth?

Long-term incentives (equity). Focus on grant size, vesting schedule (time- vs performance-based), refresh/annual top-ups, and post-termination treatment.

How do stage and size change offers?

Earlier-stage companies lean heavier on equity with lower cash; mid-market and public firms offer higher base/bonus with structured equity. Industry and growth profile also matter.

RSUs vs. stock options—what should I prefer?

- RSUs: Simpler, value tracks the share price; taxed at vest.

- Options: Upside leverage if price appreciates above the strike; require exercise planning and carry risk if the stock underperforms.

Many packages blend both for balance.

What vesting terms should I watch?

- Standard 4-year vest with a 1-year cliff and monthly/quarterly thereafter.

- Performance conditions for a portion of awards (e.g., revenue, EBITDA, strategic milestones).

- Annual refresh grants to avoid equity “dry-out.”

Which bonus metrics are healthiest for a CBO?

Metrics you can directly influence: revenue growth, margin, new business line ramp, partnerships, M&A integration, pipeline velocity, or unit economics. Ensure targets, weights, and payout curves are defined in writing.

How does geography affect CBO pay?

Large, competitive metros (e.g., Bay Area, NYC, Boston) typically pay a premium versus smaller markets. Remote roles may apply geo-based bands—clarify which band your offer uses.

What should I negotiate beyond cash?

- Equity: Initial grant size, mix (RSU/option), vesting cadence, refresh policy.

- Protections: Severance (salary, bonus, benefits continuation), non-compete scope, and change-in-control (CIC) acceleration (single- vs double-trigger).

- Bonus plan: Written metrics, target %, and payout timing.

What is double-trigger acceleration?

Unvested equity accelerates only if two events occur: (1) a change-in-control and (2) a qualifying termination (e.g., without cause or with good reason) within a set window post-CIC. It’s a common executive protection.

How do dilution and refresh grants impact value?

Future fundraising can dilute your ownership; refresh grants help maintain incentive value over time. Ask about planned dilution, option pool size, and the company’s refresh philosophy.

What documentation should I request before signing?

- Offer letter + executive employment agreement

- Equity plan, award agreements, and vesting/acceleration terms

- Bonus plan documents with metrics and payout mechanics

- Severance/CIC policy and any board-approved comp guidelines

Any negotiation tips for first-time CBOs?

- Benchmark against true peers (stage, revenue, headcount, industry, location).

- Trade base for equity if your risk tolerance and company outlook align.

- Prioritize leverage points: equity size, refresh cadence, and protections over marginal base increases.